If you are looking for an alternative to obtain some extra funds, the app that lets you borrow money till payday can be a decent helping hand. In many cases, you don’t want to utilize your savings to support your immediate cash needs.

Need Money Fast?

Fill the application below and get money instantly

Get Money Now

A borrow money app is one of the best solutions when it comes to borrowing from the comfort of your office or home. Here are the top-rated money loaning apps to help you fund your urgent needs.

Borrow Cash With App: Money Online Without Hassle

Thousands of people tend to live from paycheck to paycheck. It means they just have enough income to support their daily needs and other necessities while even a small financial emergency can easily unsettle them.

It may be rather time-consuming to travel from one lender to another and gather all the necessary information. Financial emergencies can’t wait that long so you should act quickly. What is the best solution?

Money borrow app is a great alternative to other creditors and finance-related service providers. This feature allows consumers to get funded directly from home or office without any hassle.

You just need your smartphone or laptop to obtain the amount of cash you urgently need. It’s so easy and fast that you will be able to return to your normal life within the same day.

Apps That Loan You Money Instantly

The Internet is booming with a huge choice of alternative personal loan services and online apps. Is it possible to select the best one? Yes, we have conducted our unbiased analysis and are ready to present the list of the top-rated money loaning apps to help you choose the best app to borrow money today.

You can find all the details about each app, their pros and cons, the amount range, the fees and charges, as well as the APR to help you make the right decision.

Download Now

PaydaySay

This borrowing app is suitable for iPhone and iPad users. It allows consumers to get matched with a large database of direct creditors directly through this streamlined app and obtain the amount they require.

The application process is digital and hassle-free while borrowers only need to insert their basic personal details and financial information. The repayment period varies between 65 days and 2 years depending on your loan agreement and the sum you borrow.

Amount Rate:

You can take out from $100 to $2,500 loan for any purpose and obtain this sum within the same business day.

APR:

The APR varies from 5.99% to 35.99% and it comprises the initial interest rate and any extra charges that might be requested by the creditor. Every creditor may have different terms and fees so you should check this information with each lender but the app is absolutely free for you.

Pros:

- Speed. This is a compelling app to borrow money instantly and it allows each consumer to obtain the necessary financial assistance very quickly. All you need is to submit your web request form on this app and reach multiple creditors.

- Security. The personal and banking data of each client are securely stored in this app and will never be disclosed to third parties. Each consumer is highly valued.

- No credit check. If you are worried about having a less-than-perfect rating you may forget about your doubts. Here you won’t get any credit inquiry so every borrower may get approved.

Cons:

- Not a direct creditor. This app isn’t the direct lender so it can’t make any lending decisions or issue the funds to the borrowers. Everything depends on your application information and the lenders will choose whether to lend you the money and on what terms.

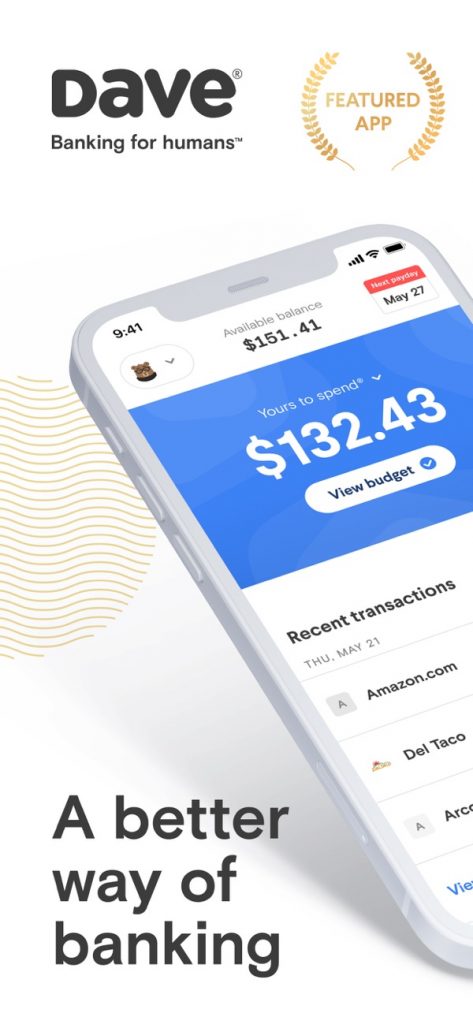

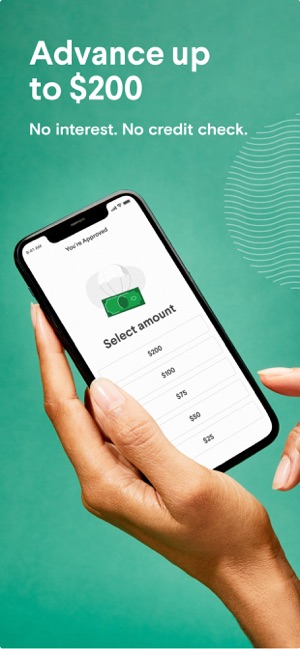

Dave

This is another useful borrow cash app to choose from. You can obtain quick additional cash for various needs and aims. Clients need to have an active bank account to connect it to this app and obtain fast funds. Also, there are budgeting built-in tools and extra features to help you manage your personal finances.

Unfortunately, you may only borrow $100 at a time so it’s a “borrow 100 dollars” app. If you decide to open Dave Banking Account, you will be able to increase your ability to withdraw the funds so that you can borrow up to $200.

Each month $1 will be charged from your card allowing you to use this app and its services. If you don’t have enough funds on your card you will be notified about it via SMS message or through the Mobile App.

Fees:

There is a $1 a month subscription fee for every consumer who wants to utilize the Dave app. It’s necessary to connect your credit or debit card via Payment Method in order to start using it.

Pros:

- No credit check. While many similar apps that loan you money instantly and financial providers only claim to offer such services, this cash borrowing app really doesn’t perform any credit pulls. Hence, it’s suitable for every borrower in need.

- Any credit score. If you had some issues with your credit rating, applying to this borrow app may help you avoid issues and get money instantly even with a poor rating.

- No interest rates. You don’t have to pay any charges but you may want to pay a tip if you want to support this app.

Cons:

- You can’t improve your credit. Although there are no credit inquiries and nobody asks about your credit rating, you won’t have a chance to improve it even if you want to.

- Borrowers will need to wait a few days to get funded. It may be rather frustrating especially when you have a temporary emergency and can’t wait to cover your needs.

- Extra fee. Those who want to obtain the funds within the same business day must pay $4.99.

- A small amount of cash. Keep in mind that you will only be allowed to withdraw up to $100 for your needs so if you require a larger sum you may need to opt for alternative lending solutions.

Earnin

This is a useful cash app, borrow money and get a cash advances today. In other words, you gain an opportunity to obtain the funds you have already earned but haven’t been given by your recruiter yet. It’s quick financial assistance without any charges or fees.

The application is quick and easy at this app for borrowing money. Once you fill in the amount you need, you will be issued the funds on your checking account. There is an option to obtain a cash advance and return the cash automatically on your next payday.

There are no membership fees or other charges. The amount you withdraw will be taken from your bank account on the next salary day.

Amount Rate:

Borrowers can obtain only $50 or $100. You will be able to withdraw up to $500 a day after several months.

Pros:

- No interest rates. It’s a great option for consumers who want to pay nothing more than the amount of cash they’ve borrowed. This app doesn’t have any hidden charges as well and they note you will pay only $0-14 for one loan.

- Money advance. One of the greatest benefits is the ability to take out the cash you’ve earned so far but haven’t been given by your recruiter yet. This is suitable only for full-time employees.

- Automatic withdrawal. The funds will be issued and taken directly from your bank account on the next salary day provided that you have a steady source of income.

Cons:

- Not suitable for the unemployed. If you don’t have stable employment or a full-time position, you won’t be able to qualify.

- A small amount of cash.

MoneyLion

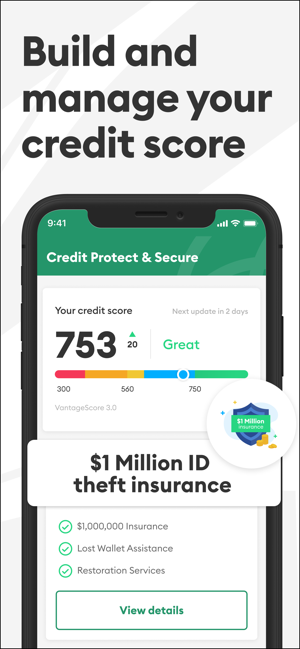

This is another popular cash app, borrow feature allows consumers to get funded within the next business day and utilize the money for their urgent needs. There are two types of membership – core and plus.

If you want to avoid fees you may choose the core membership as it’s free of charge. The plus membership will cost you $28 per month.

Amount Rate:

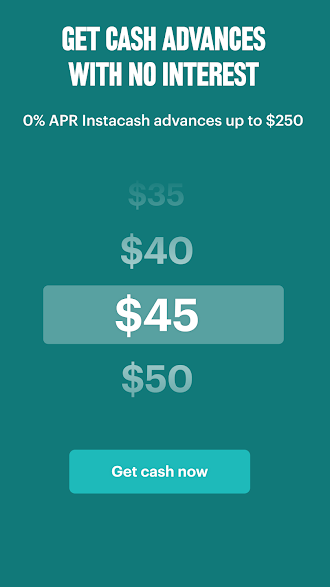

Consumers may request up to $250 for various purposes through this cash advance app without any fees (but only if they paid for membership).

Core membership doesn’t cost anything. If you select the plus membership, you will qualify for special loans with a 5.99% APR that are suitable for improving the credit rating.

Pros:

- No credit check. While many similar money borrowing apps and financial providers only claim to offer such services, this borrow cash app really doesn’t perform any credit pulls. Hence, it’s suitable for every borrower in need.

- Accept any credit score. If you had some issues with your credit rating, applying to this lend and borrow app may help you avoid problems and get funded even with a poor credit rating.

- No interest rates. If you have a core membership is doesn’t cost you anything and you can obtain a small amount of cash advance without any fees.

Cons:

- Plus membership costs $28 a month. It has extra features but not many consumers will be eager to pay such money on a monthly basis even when they don’t need to borrow the funds

- You can’t boost your rating. If you have core membership you may only obtain a small cash advance without the ability to boost your credit history if you need to.

Brigit

This is another helpful app, borrow money for your urgent needs and receive them directly into your checking account. This app is suitable for many consumers and it even allows you to extend the due date up to three times provided that you have temporary issues with loan repayment.

Clients may request up to $250 for various purposes through cash advance app. The application process is quick and unbiased as there are no hidden charges.

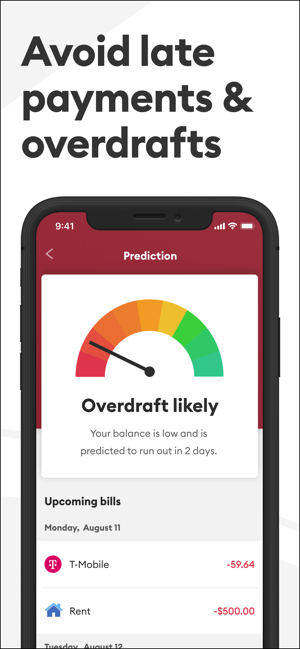

Borrowers also receive balance and bill alerts to get reminded about the upcoming bills so that they can act quickly and avoid late fees.

Fee:

You need to pay $9.99 each month for the membership if you want to utilize this app.

Pros:

- Special features. One of the biggest benefits of this lend and borrow app is the ability to receive notifications each time you are going to experience an overdraft. This way the app helps to keep track of your spending.

- Customer support. Only this app has email customer support. On the other hand, the managers usually answer within two business days which might be too long.

- Due date extension. This is another advantage of this money borrow app. Clients have an opportunity to extend the due date two or three times if necessary.

Cons:

- Slow money deposit. Borrowers will have to wait for about three business days to obtain the required funds. It may be too slow for urgent monetary disruptions and other emergencies.

- Monthly fee even if you don’t require a loan this month.

Borrow Cash Advance Apps Feature: Choose the Best One

There is a wide choice of money borrowing apps today. It may be tough to select the best option. However, if you review the mentioned features, compare all the benefits and drawbacks of each app, you will be ready to make a smart financial decision.

Depending on your immediate cash needs, your credit rating, as well as your steady income source, you may choose between these top 5 cash advances apps. There is no one-size-fits-all app as everything depends on your monetary stability and urgent needs.

Borrow Responsibly

If you are also unprepared for financial disruptions and every new additional monetary need makes you feel frustrated and stressed out, choosing the best money borrowing app may support your urgent needs without delay.

There are many benefits of choosing an app to borrow money instantly instead of going to the local bank or pawnshop to get 1500 dollar loan. There is a wide variety of lending institutions in every city today. But you never know all the differences and nuances of each creditor.

Every potential borrower needs to understand that he or she takes full responsibility for the loan or cash advances they obtain. This cash shouldn’t be taken for granted as this sum is only borrowed for the short period.

Also, long-term goals can’t be covered with such small amounts of cash. Think about alternative ways of funding your long-term aims and needs or try to improve your earning potential.